There is a clear association between governance, corruption, rule of law, and investment, though it plays out in complex ways. Countries with stronger institutions, predictable regulations, and stable policies attract sustainable, long‑term capital because investors trust rules will be applied fairly. Governance quality shapes FDI inflows, strong institutions mitigate risks while corruption deters. Enforced contracts, protected property rights, and independent courts reassure investors why weak rule of law forces reliance on political connections, offshore arbitration, or risk premiums, limiting investment diversity and quality.

Mo Ibrahim in 2024 highlights governance and transparency challenges and ranking Nigeria 33rd out of 53 African nations. The Transparency and Integrity Index echoed this trend and cited persistent failures in accountability and enforcement. Strikingly, Nigeria ranks 120th out of 142 countries in the Rule of Law Index, behind nations like Rwanda, Botswana, and Ghana. These poor ratings reflect a deteriorating investment climate that is disclaiming Nigeria billions in capital and growth.

Policy paralysis, regulatory uncertainty, and labour disputes deter investors both foreign and domestic. When Africa’s largest economy isn’t among investors’ favourite due to operational stability, it obviously suggests the collapse of investor confidence. Outliers like Dangote though planning expansions to rival world’s biggest refinery battled a quagmire of regulatory delays, conflicting policies, irregular crude supply, and escalating labour disputes from inception. Multinationals such GlaxoSmithKline exited Nigeria after 51 years of operation. Others include Shoprite, Etisalat, and Intercontinental Group citing regulatory opacity, corruption, and insecurity as reasons for scale back or entire exit. Each exit complicates the task of President Bola Tinubu, governors, and local leaders in attracting foreign direct investment, underscoring that governance gaps, absence of rule of law, and entrenched corruption in some African countries are not just political concerns, but signals economic crisis.

Governance, Corruption, & Rule of Law

Nigeria, alongside Egypt, Ethiopia, Kenya, Rwanda, South Africa, and Mauritius, provides a comparative context for evaluating investor confidence, governance performance, and economic reform potentials across Africa. Global indices such as WJP Rule of Law Index which measure constraints on government powers, absence of corruption, open government, fundamental rights, order and security, regulatory enforcement, civil justice, and criminal justice, Mo Ibrahim Index of African Governance (IIAG) that evaluates leadership, transparency, and accountability across African states; and Transparency International Corruption Perceptions Index (CPI) that ranks countries based on perceived levels of public sector corruption shape investors’ perceptions. Nigeria, Egypt, Ethiopia, Kenya, Rwanda, South Africa, and Mauritius serving as strategic gateways within their sub-zones can serve as a benchmark for the evolving investment landscape within the African continent.

Considering both the average absolute trend (AAT ’14–’23) and the most recent five‑year trend (AAT ’19–’23), alongside 2023 governance levels on leadership, transparency, and accountability, Mo Ibrahim Index of African Governance gives a picture of how Nigeria, Egypt, Ethiopia, Kenya, Rwanda, South Africa, and Mauritius rank on overall governance.

Mauritius and South Africa remain at top governance levels, though both are deteriorating, while Kenya and Egypt are the only ones with consistent upward trends, with Egypt showing the sharpest recent gains. Rwanda is holding ground but plateauing while Nigeria and Ethiopia are at the bottom, with weak scores and negative recent momentum.

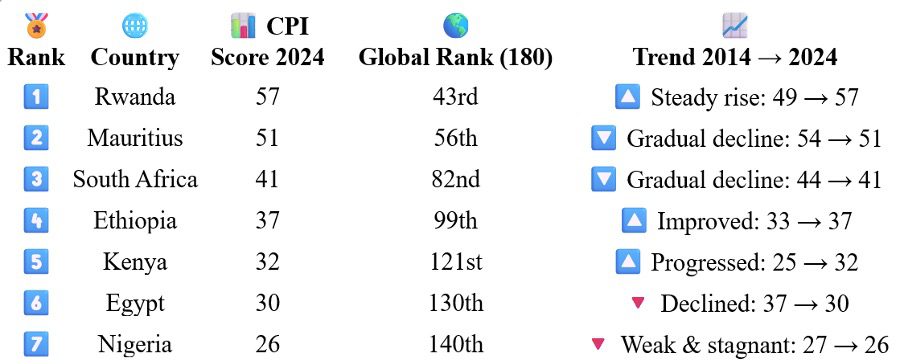

On perceived levels of public sector corruption, the 2024 Corruption Perception Index which (scores out of 100: higher = cleaner, less corrupt, better performance), amongst the seven countries of interest in this study Rwanda ranks 1st with the cleanest reputation in Africa. Meanwhile, Seychelles comes 1st for African countries, ranking 18th out of 180 countries across the globe with a CPI score of 72 in 2024.

Mauritius also performs strongly, though its score has declined. South Africa remains mid‑tier though slithering slightly. Ethiopia shows gradual improvement, while Kenya made gains. Egypt has deteriorated over the decade, while Nigeria is amongst the weakest, with one of the lowest CPI scores globally alongside Cameroon and Uganda at 140th position only performing better than countries such as Mozambique, CAR, Congo at 146th, 149th, 151st respectively.

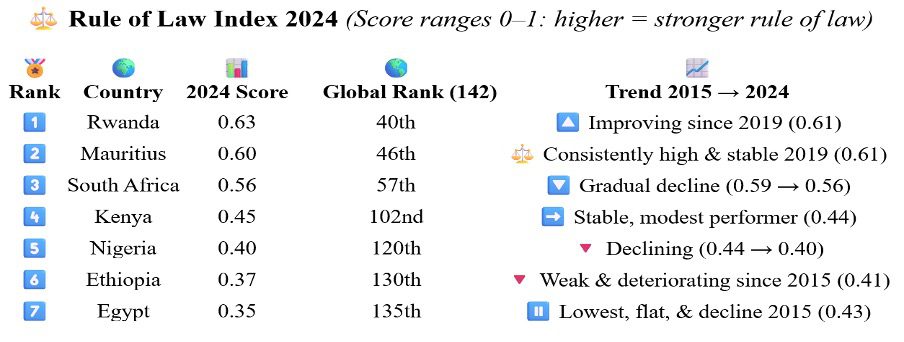

On Rule of Law (RoL) Index (Score ranges 0–1: higher = stronger rule of law), Rwanda steadily strengthening its institutions leads the group as well as African countries out of 142 ranked countries in the 2024 Rule of Law scores.

Mauritius remains a model of stability. South Africa shows a slow but noticeable decline. Kenya holds steady but struggles. Nigeria, Ethiopia, and Egypt face serious RoL concerns, with Egypt at the bottom and Ethiopia sliding backward.

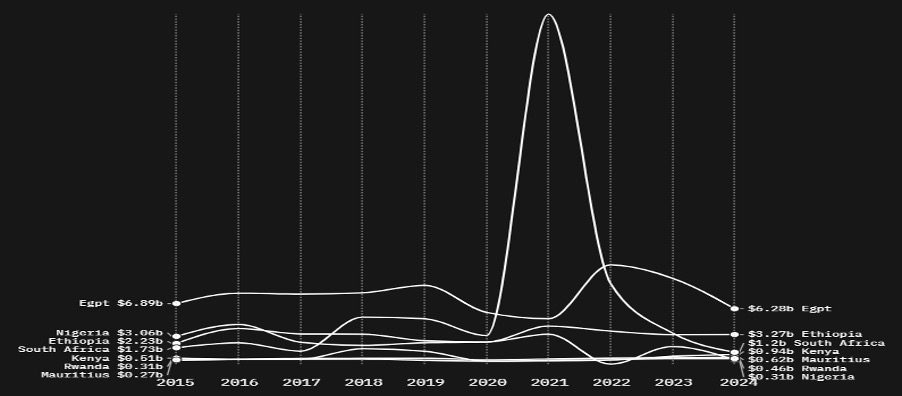

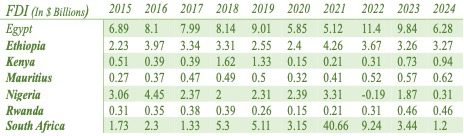

FDI, a macroeconomic indicator underscores the impact of governance on investor behaviour see World Bank FDI Indicators, UNCTAD World Investment Reports.

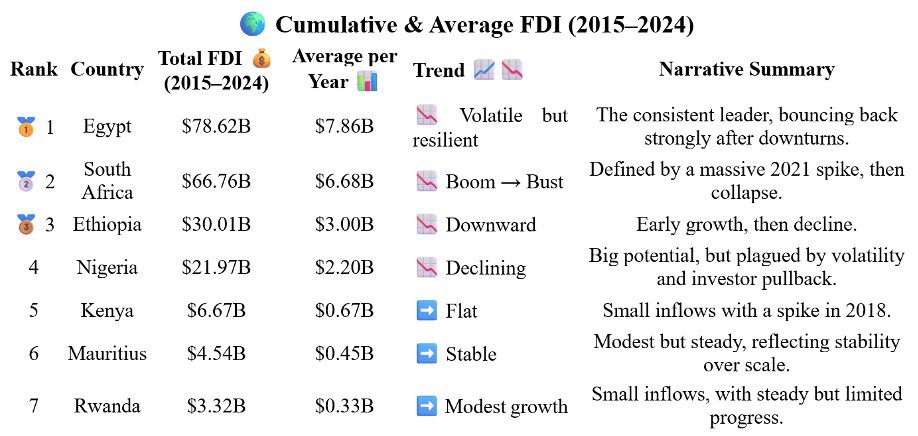

Within 2015 – 2024, while South Africa spiked at $40.66B in 2021 before sliding to $1.2B in 2024, Egypt led by total inflows peaking at $11.4B in 2022 before easing to $6.28B in 2024.

Ethiopia remained around $2.4–$4.26B in 2021, Mauritius edged up to $0.6B in 2024, and Kenya rose from $0.15B in 2020 to $0.94B in 2024. Nigeria swung from $4.45B in 2016 to -$0.19B in 2022 and $0.31B in 2024.

Ranking the countries by their total and average FDI over the decade, Egypt leads the group averaging nearly $8B annually.

South Africa edges closer to Egypt because of its 2021 spike, but with an unstable trend. Ethiopia and Nigeria are mid-tier players, both trending downward despite decent totals. Kenya, Mauritius, and Rwanda at the bottom probably limited by smaller economic sizes.

Investor Confidence & FDI Inflows

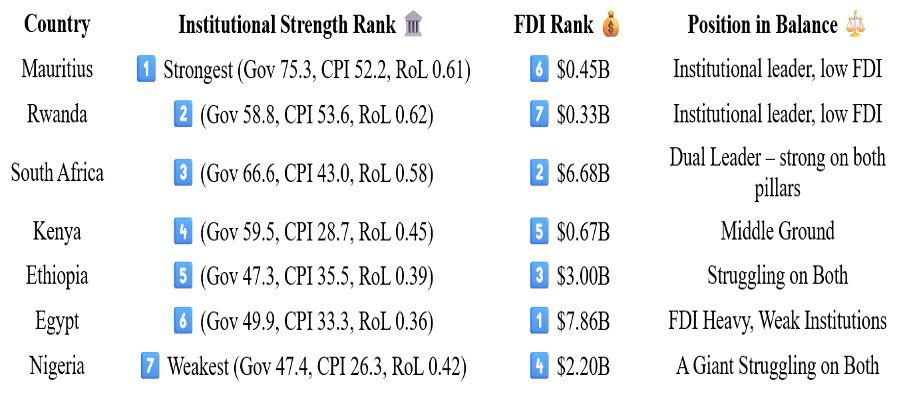

FDI, Governance, CPI, and Rule of Law were comparatively combined to essentially split the seven countries into two separate leaderboards (Institutions vs. FDI), showcasing balance “best overall,” lopsided versus well-rounded.

Mauritius & Rwanda, uppermost in governance, but with small FDI inflows suggesting they couldn’t convert credibility into capital probably because of market size. South Africa is the only country amongst the seven that scores high on both sides, suggestive of a true balanced pair. Egypt mirrors opposite of Mauritius, huge FDI inflows despite weak institutions, showing how market size and reforms can outweigh governance flaws. Ethiopia attracts more FDI than its governance suggests, while Nigeria underperforms on both despite market size. Kenya, stuck in the middle, decent institutions, modest FDI. As such, the ranking highlights the trade-offs between credibility vs. capital. Mauritius and Rwanda win on credibility, Egypt on capital, but South Africa is the only country that balances both.

FDI, Governance, CPI, Rule of Law, & Investment Attractiveness Index

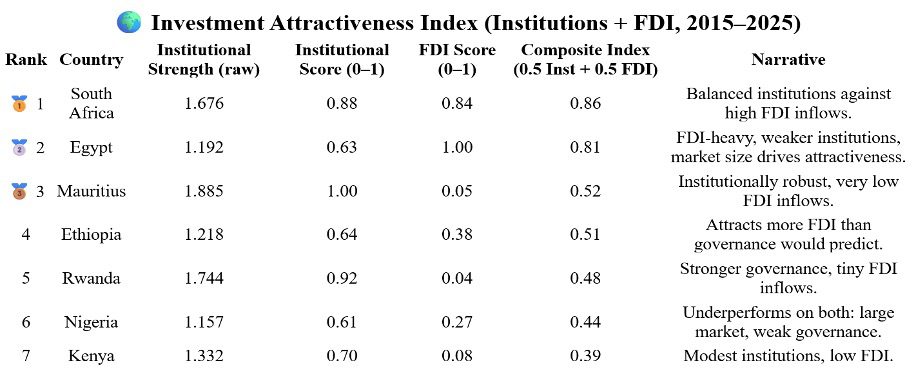

Sustainable capital attractiveness requires aligning institutional strength with market opportunity. In an attempt to perceive how institutional strengths within a country influence the attractiveness of FDI, Governance, CPI, Rule of Law, and FDI, were combined into a single integrated Investment Attractiveness Index (IAI) for each of the seven countries. An attempt to avoid the trap of considering only governance or only FDI distinctly, helping a comparison that highlights balance and reveals mismatches. The IAI was derived using the pattern in the flow diagram.

The single IAI designed to portray a holistic view of how each country balances institutional credibility with capital attraction, reveals sharp contrasts within the Africa’s investment landscape.

Egypt attracts capital despite weak institutions, Mauritius and Rwanda show trustworthiness without scale in capital attraction, South Africa seems to have balanced both despite volatility, while Nigeria illustrates how fragile governance corrodes confidence.

In conclusion, Nigeria, Egypt, and South Africa all face governance weaknesses, yet their FDI outcomes diverge because investors weigh more than market size; macroeconomic stability, security, infrastructure, and institutional credibility are correspondingly deeply considered. Egypt has reassured investors through bold reforms and infrastructure expansion, while South Africa leverages deep financial markets, diversified sectors, and dependable institutions despite volatility. Nigeria, by contrast, suffers from currency instability, insecurity, weak infrastructure, and fragile institutions, leaving FDI highly volatile and concentrated in oil.

The lesson for Nigeria and peers is clear: from Egypt and South Africa, the importance of macroeconomic stability, bankable projects, and logistics modernization; from Mauritius and Rwanda, investor‑friendly governance, rule of law, and branding are valued. Size is an advantage, but without trust it is squandered. By combining reform decisiveness, infrastructure efficiency, institutional reliability, and service‑oriented governance, African economies can transform scale into sustained investor confidence and become magnets for global capital.